Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shreeji Shipping Global Ltd (SHREEJISPG), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Shreeji Shipping Global Ltd

Industry: Shipping

Listing At: NSE & BSE (Mainboard)

Overview:

Shreeji Shipping Global Limited: A Profile

Shreeji Shipping Global Limited began its journey as a partnership firm, M/s Shreeji Shipping, on June 14, 1995. The company transitioned into a private limited company, Shreeji Shipping Global Private Limited, on April 11, 2024, following a resolution passed by its partners. Later that year, on October 17, 2024, the company’s shareholders approved its conversion to a public limited company. This led to a name change to Shreeji Shipping Global Limited, with a new certificate of incorporation issued on November 18, 2024.

Vision & Mission

The company’s vision is to become a leading provider of port-based services, continually setting new benchmarks for quality within the industry. Its mission is centered on a client-oriented culture, aiming to promote business growth through innovative technology and infrastructure. Shreeji Shipping Global Limited also focuses on boosting employee morale, building long-term relationships, and ensuring its qualified personnel deliver flawless services. The organization emphasizes strong internal communication to facilitate seamless services, meet deadlines, and enhance collaboration across all its departments, including marketing, logistics, operations, finance, legal, and customer support.

Operations

Shreeji Shipping Global Limited provides services at both all-weather and seasonal ports in India and Sri Lanka. The seasonal ports cease operations during the monsoon months due to unfavorable weather conditions.

Shariah Status

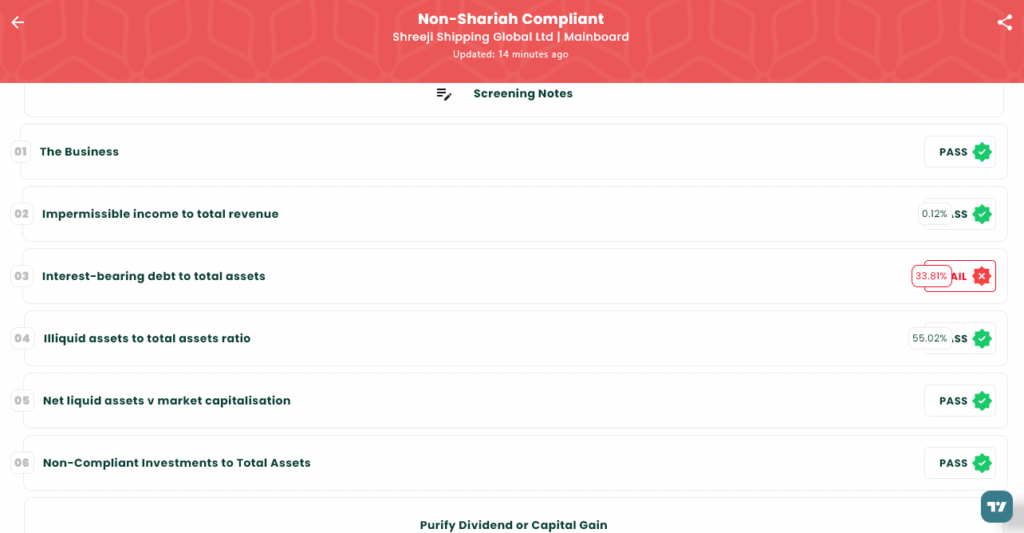

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 19, 2025 |

| IPO Close Date | Thu, Aug 21, 2025 |

| Tentative Allotment | Fri, Aug 22, 2025 |

| Initiation of Refunds | Mon, Aug 25, 2025 |

| Credit of Shares to Demat | Mon, Aug 25, 2025 |

| Tentative Listing Date | Tue, Aug 26, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 21, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 58 | ₹14,616 |

| Retail (Max) | 13 | 754 | ₹1,90,008 |

| S-HNI (Min) | 14 | 812 | ₹2,04,624 |

| S-HNI (Max) | 68 | 3,944 | ₹9,93,888 |

| B-HNI (Min) | 69 | 4,002 | ₹10,08,504 |

Financials

The company’s revenue saw a significant 17% decline between March 31, 2024, and March 31, 2025. Despite a reported rise in profit after tax (PAT), this appears to be overshadowed by a steep drop in Total Income from ₹736.17 crore to ₹610.45 crore. Furthermore, the company’s Total Borrowing has alarmingly surged from ₹158.88 crore to ₹256.47 crore, a substantial increase that could pose future risks.

KPI

| KPI | Values |

|---|---|

| ROE | 42.91% |

| ROCE | 28.09% |

| Debt/Equity | 0.75 |

| RoNW | 42.91% |

| PAT Margin | 23.24% |

| EBITDA Margin | 33.03% |

| Price to Book Value | 10.76 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.