Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Sri Lotus Developers & Realty Ltd IPO (LOTUSDEV), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Sri Lotus Developers & Realty Ltd IPO (LOTUSDEV)

Company Name: Sri Lotus Developers & Realty Ltd

Industry: Realty

Listing At: NSE & BSE (MAINBOARD)

Overview:

Lotus Developers boasts a diverse portfolio of ultra-luxury and luxury residential and commercial properties. The company aims to enhance project value by creating superior living environments through comprehensive community facilities and by collaborating with specialized experts. Their core competency lies in the professional management of the real estate value chain, with in-house teams overseeing every project stage from conceptualization to completion. All projects undergo meticulous market research and analysis to pinpoint optimal locations.

Mumbai’s status as India’s commercial capital, combined with its high-income demographic and growing segment of young professionals, provides a robust market for Lotus Developers’ ultra-luxury and luxury residential properties in the city’s western suburbs. Their commitment to customer satisfaction and safety has resulted in a significant number of satisfied clients over the years.

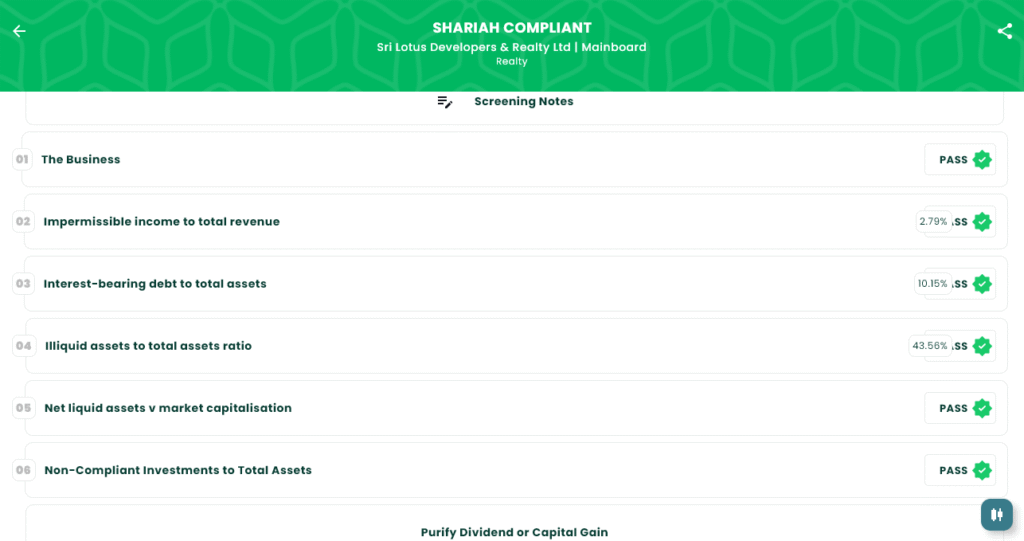

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 30, 2025 |

| IPO Close Date | Fri, Aug 1, 2025 |

| Tentative Allotment | Mon, Aug 4, 2025 |

| Initiation of Refunds | Tue, Aug 5, 2025 |

| Credit of Shares to Demat | Tue, Aug 5, 2025 |

| Tentative Listing Date | Wed, Aug 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 1, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 100 | ₹15,000 |

| Retail (Max) | 13 | 1,300 | ₹1,95,000 |

| S-HNI (Min) | 14 | 1,400 | ₹2,10,000 |

| S-HNI (Max) | 66 | 6,600 | ₹9,90,000 |

| B-HNI (Min) | 67 | 6,700 | ₹10,05,000 |

Financials

The financial data for Sri Lotus Developers & Realty Ltd. shows impressive growth from March 2023 to March 2025. Assets surged dramatically from 486.23 to 1,218.60. Revenue experienced significant growth, reaching 569.28 in 2025 from 169.95 in 2023, with a notable 22% increase between 2024 and 2025. Profit After Tax (PAT) demonstrated exceptional performance, rising by 91% from 119.14 in 2024 to 227.89 in 2025, and a staggering increase from just 16.80 in 2023. EBITDA, Net Worth, and Reserves and Surplus also reflect this strong upward trajectory, indicating robust financial health and expansion.

KPI

| KPI | Values |

|---|---|

| ROE | 24.39% |

| ROCE | 27.22% |

| Debt/Equity | 0.13 |

| RoNW | 24.39% |

| PAT Margin | 41.46% |

| EBITDA Margin | 52.57% |

| Price to Book Value | 7.01 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.