Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Takyon Networks Ltd IPO (TAKYON), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Takyon Networks Ltd IPO (TAKYON)

Company Name: Takyon Networks Ltd

Industry: IT Enabled Services

Listing At: BSE SME

Overview:

We embarked on our journey in 2009 with the vision of providing turnkey solutions in voice and data systems that can cater to the IT infrastructure needs of many government and corporate clients. Gradually, we expanded our services in IT Infrastructure, System Integration, Video Conferencing, Surveillance and Security, Network Security, Power Conditioning, and Customized Software Solutions. During the course of time, we managed to reach heights in the IT Infrastructure and IT Consulting market with our high-standard end-to-end solutions and secured a position amongst top companies in Lucknow. Adherence to stringent ethical standards and the use of creative IT tools, make Takyon Networks capable of optimally satisfying the needs of its clients. With the support of our team of dedicated professionals who consistently strive to achieve excellence, we offer valued services to our esteemed clients that enable them to flourish and outperform their opponents, eventually rising to the top of their respective domains.

Mission:

To collaborate with esteemed organizations in their digital transformation journey that will create noticeable, long-term, and significant improvements in their performance.

Vision:

To be recognized across the globe as the specialist in our sector of expertise by offering unmatched quality of our products and services.

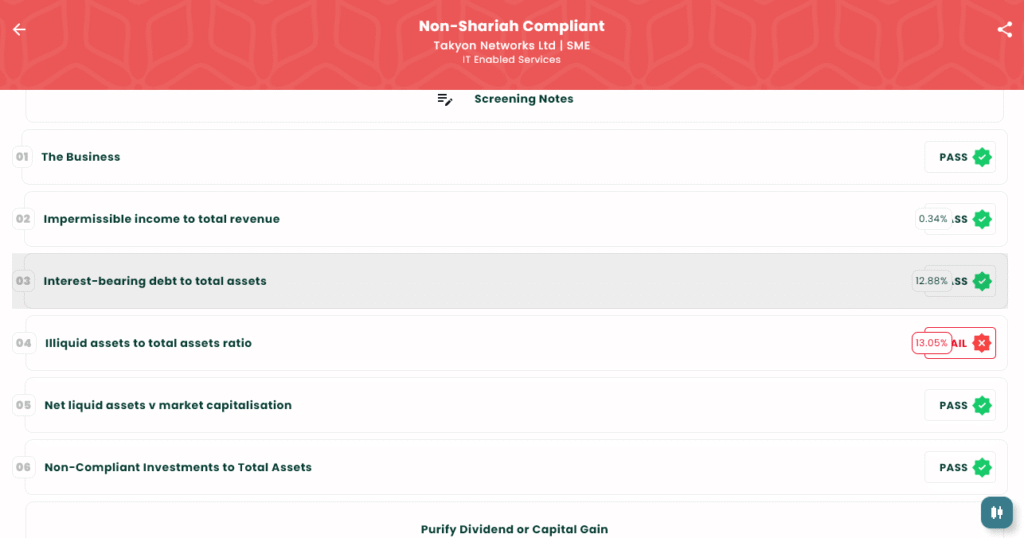

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 30, 2025 |

| IPO Close Date | Fri, Aug 1, 2025 |

| Tentative Allotment | Mon, Aug 4, 2025 |

| Initiation of Refunds | Tue, Aug 5, 2025 |

| Credit of Shares to Demat | Tue, Aug 5, 2025 |

| Tentative Listing Date | Wed, Aug 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 1, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 4,000 | ₹2,16,000 |

| Individual investors (Retail) (Max) | 2 | 4,000 | ₹2,16,000 |

| S-HNI (Min) | 3 | 6,000 | ₹3,24,000 |

| S-HNI (Max) | 9 | 18,000 | ₹9,72,000 |

| B-HNI (Min) | 10 | 20,000 | ₹10,80,000 |

Financials

Assets consistently grew from 69.67 to 85.70, indicating expansion. Revenue surged significantly from 63.97 to 103.48. Profit After Tax more than doubled, from 2.81 to 6.96, highlighting improved profitability. Similarly, EBITDA rose robustly from 5.19 to 12.20, signifying stronger operational earnings. Net Worth steadily increased from 22.86 to 35.22, boosting shareholder value. Reserves and Surplus also grew, demonstrating enhanced financial stability. Overall, the data portrays a company on a strong and consistent growth trajectory over these three fiscal years. But the company fails in one rule i.e Rule No. 4

KPI

| KPI | Values |

|---|---|

| ROE | 21.92% |

| ROCE | 24.43% |

| Debt/Equity | 0.34 |

| RoNW | 19.75% |

| PAT Margin | 6.75% |

| EBITDA Margin | 11.83% |

| Price to Book Value | 2.01 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for TAKYON IPO as on 29th July 2025 is currently ₹0, representing 0% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.