Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Umiya Mobile Ltd IPO (UML), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Umiya Mobile Ltd IPO (UML)

Company Name: Umiya Mobile Ltd

Industry: Consumer Electronics & Durable

Listing At: BSE SME

Overview From Company’s Website:

At Umiya Mobile Pvt. Ltd., we have only one goal: to live and share happiness. Our purpose is to positively impact our customers, employees, vendors, and community in a responsible and authentic manner by spreading smiles.

We want people to remember Umiya Mobile not about our beginning selling SIM cards but want them to remember Umiya Mobile as a household name mantled with innovation, trust, and multi-brand service in the mobile outlets in the coming times.

UMPL has been experiencing steady growth since 15 years with its wide portfolio of communication products including mobile, accessories, and after-sale services. We have made a long way to success, we bring together the skills, dedication of team members that are towards the precision and latest trends and technologies.

Today, UMPL is an Authorised Reseller for major mobile brands, direct billing for Apple, Samsung (TOT), Realme, MI, Poco, Tecno, and Motorola.

Shariah Status

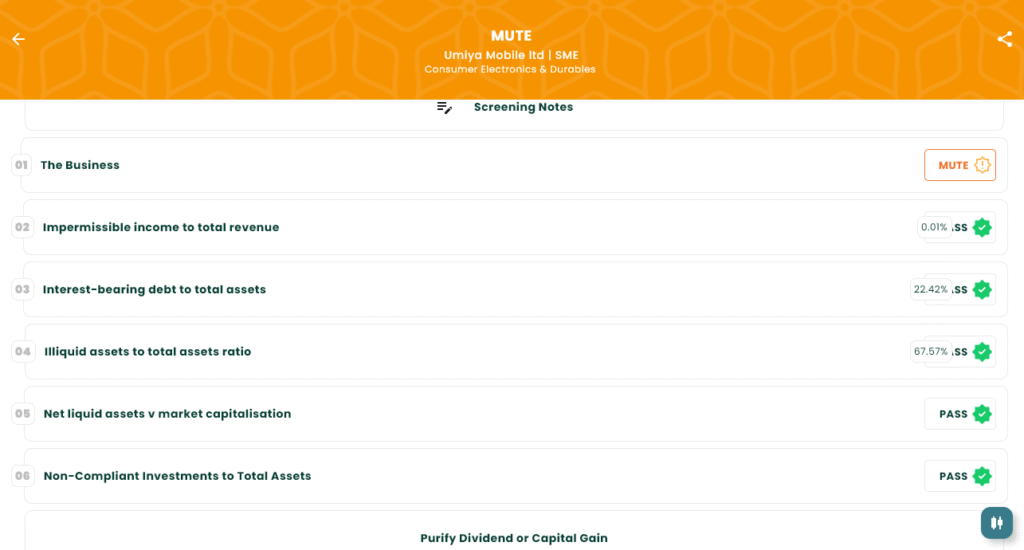

The IPO is MUTE, please see below image.

According to screening notes: Umiya Mobile Ltd is a growing multibrand electronics and appliance retailer operating across Gujarat, Maharashtra, and nearby regions. It offers a wide range of tech products like smartphones, tablets, laptops, accessories, and smart TVs under its home appliances category. However, since the company is involved in the sale of TVs and the RHP does not provide a clear revenue breakdown for this segment, we remain MUTE on the TV business income from a Shariah perspective due to lack of transparent data.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Mon, Jul 28, 2025 |

| IPO Close Date | Wed, Jul 30, 2025 |

| Tentative Allotment | Thu, Jul 31, 2025 |

| Initiation of Refunds | Fri, Aug 1, 2025 |

| Credit of Shares to Demat | Fri, Aug 1, 2025 |

| Tentative Listing Date | Mon, Aug 4, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 30, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 4,000 | ₹2,64,000 |

| Individual investors (Retail) (Max) | 2 | 4,000 | ₹2,64,000 |

| HNI (Min) | 3 | 6,000 | ₹3,96,000 |

Financials

Umiya Mobile Ltd. showed strong growth in FY 2025. Its revenue rose by 33% to ₹601.28 crore, up from ₹451.58 crore in FY 2024. Profit after tax grew sharply by 141% to ₹5.66 crore from ₹2.35 crore. EBITDA more than doubled to ₹10.94 crore from ₹5.76 crore. The company’s assets increased to ₹105.23 crore, and net worth rose to ₹13.98 crore. However, total borrowing also increased to ₹23.60 crore. Despite a drop in reserves and surplus from ₹7.77 crore to ₹3.53 crore.

KPI

KPI as of Mon, Mar 31, 2025.

| KPI | Values |

|---|---|

| ROE | 50.79% |

| ROCE | 27.64% |

| Debt/Equity | 1.69 |

| RoNW | 40.51% |

| PAT Margin | 0.94% |

| EBITDA Margin | 1.82% |

| Price to Book Value | 4.93 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Umiya Mobile Ltd IPO is currently ₹0, representing 0% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.