Unified Data-Tech Solutions Ltd, a technology company based in Mumbai, has opened its Initial Public Offering (IPO) on the BSE SME platform. The company operates in the IT and digital infrastructure space, offering a range of enterprise-level solutions such as data center services, network security, cloud technology, and application delivery systems. This Initial Public Offering is significant in the context of Unified Data-Tech Solutions IPO.

Investors are keenly watching the Unified Data-Tech Solutions IPO for its potential impact on the market.

This article covers all key details about the Unified Data-Tech Solutions IPO, including its price band, lot size, business model, GMP, and Shariah compliance status as reported by IslamicStock. Understanding the Unified Data-Tech Solutions IPO is crucial for potential investors.

IPO Snapshot

Here’s a quick look at the key aspects of the Unified Data-Tech Solutions IPO structure and timeline:

- IPO Name: Unified Data-Tech Solutions Ltd IPO

- IPO Code: UNIDATA

- IPO Type: Bookbuilding IPO

- Issue Size: ₹144.47 crore

- Price Band: ₹260 to ₹273 per equity share

- Face Value: ₹10

- Lot Size: 400 shares

- Minimum Investment (Retail): ₹1,09,200

- IPO Opening Date: May 22, 2025

- IPO Closing Date: May 26, 2025

- Basis of Allotment: May 27, 2025

- Listing Date: May 29, 2025

- Exchange: BSE SME

These dates are based on public filings and listings from IPO aggregators like Chittorgarh and InvestorGain.

Company Overview

Unified Data-Tech Solutions Ltd was founded in 2010 and has grown to become a trusted IT partner for private enterprises and government agencies. The company provides technology solutions in the following categories:

- Data Center Infrastructure & Hosting

- Cybersecurity & Network Management

- Virtualization & Hybrid Cloud

- System Integration

- IT Consulting Services

Unified Data-Tech Solutions supports its clients with a full stack of services that help them upgrade legacy systems and adopt secure, modern IT frameworks. The company’s business model is project-based and includes post-implementation support, making it attractive to clients seeking long-term technical partnerships.

As demand for secure and scalable IT infrastructure grows in both public and private sectors, Unified Data-Tech is positioning itself to tap into this expanding market.

Grey Market Premium (GMP)

As of May 22, 2025, the GMP for Unified Data-Tech Solutions IPO is approximately ₹121. This suggests a possible listing price of ₹394 (i.e., ₹273 + ₹121), indicating an estimated premium of 44.32% over the upper end of the price band.

Please note that GMP figures are unofficial and subject to market fluctuations. They do, however, offer an early indication of investor sentiment.

Shariah Compliance Status

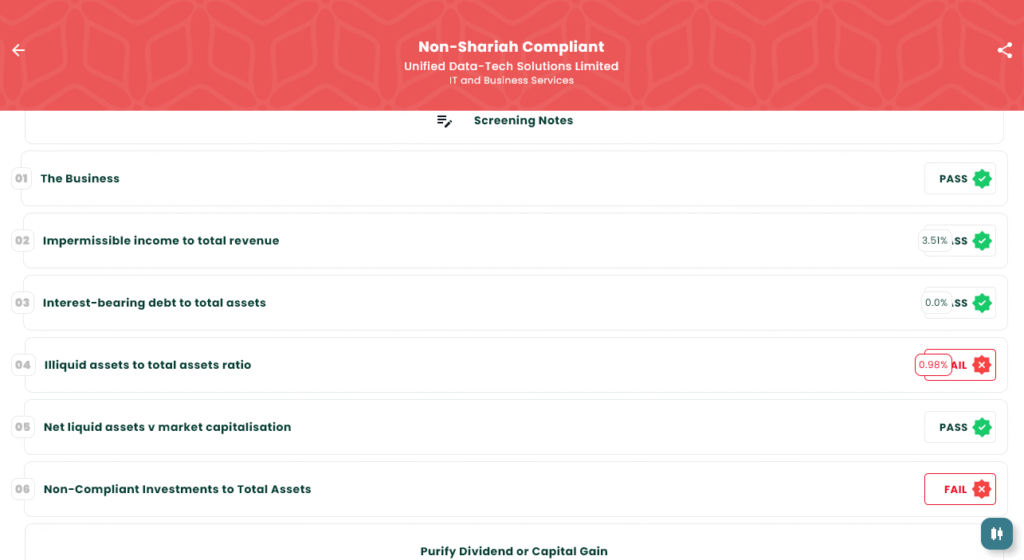

According to IslamicStock, the Unified Data-Tech Solutions IPO is classified as Non-Shariah Compliant.

Although the company passes several key financial filters, including:

- Business activity: Pass

- Interest-bearing debt: 0%

- Impermissible income: 3.51% (within limits)

But it fails in Rule 4 and Rule 6, which involves illiquid assets to total assets percentage and investment in non-compliant instruments to the total assets percentage. The company reportedly holds funds in body corporate entities, mutual funds, and fixed deposits, which are not allowed under Islamic investment guidelines.

Understanding the Unified Data-Tech Solutions IPO Landscape

Because of this, investors who follow Shariah-based investment criteria may find the IPO does not meet their standards, even though its operational business is otherwise permissible.

Final Thoughts

The Unified Data-Tech Solutions IPO brings a mid-sized tech company to the SME platform with a growing footprint in India’s digital infrastructure space. The firm has a strong client list and offers relevant services in cloud, security, and system integration.

However, IslamicStock’s screening reports a non-compliant Shariah status due to the company’s investments in restricted financial instruments. This may be important for investors who filter their portfolios based on Islamic finance guidelines.

As always, readers should refer to the official prospectus, company filings, and consult certified investment advisors for further guidance.

Disclaimer

This article is for informational purposes only. It does not offer investment advice or a recommendation to buy, sell, or subscribe to any securities. Please consult with a SEBI-registered investment advisor before making financial decisions. Shariah compliance details are based on publicly available information from IslamicStock and are shared for educational purposes only.