Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Vikran Engineering Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Vikran Engineering Ltd

Industry: Civil Construction

Listing At: NSE & BSE (Mainboard)

Overview:

VIKRAN stands as one of the fast-growing Indian Engineering, Procurement and Construction (EPC) company, boasting a rapid growth trajectory with a targeted turnover of 500 Cr. (FY 19-20). Our extensive portfolio covers a spectrum of essential services, ranging from infrastructure projects to Power Transmission and EHV substations reaching up to 765kV. Moreover, we specialize in ensuring Power Distribution, handling every aspect from the 33/11kV Substation to the end consumer’s meter connection.

With a comprehensive suite of offerings encompassing Design, Supply, Civil Works, Construction, and Testing and Commissioning.

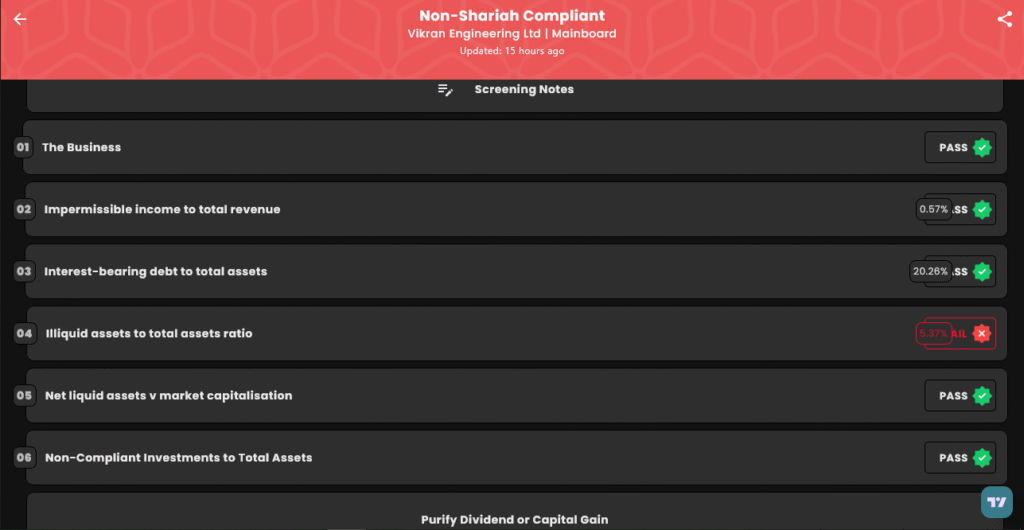

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 26, 2025 |

| IPO Close Date | Fri, Aug 29, 2025 |

| Tentative Allotment | Mon, Sep 1, 2025 |

| Initiation of Refunds | Tue, Sep 2, 2025 |

| Credit of Shares to Demat | Tue, Sep 2, 2025 |

| Tentative Listing Date | Wed, Sep 3, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 29, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 148 | ₹14,356 |

| Retail (Max) | 13 | 1,924 | ₹1,86,628 |

| S-HNI (Min) | 14 | 2,072 | ₹2,00,984 |

| S-HNI (Max) | 69 | 10,212 | ₹9,90,564 |

| B-HNI (Min) | 70 | 10,360 | ₹10,04,920 |

Financials

The provided financial data for Vikran Engineering Ltd. shows key metrics for the fiscal years ending March 31, 2025, March 31, 2024, and March 31, 2023. The data indicates that the company’s revenue increased by 17% and its profit after tax (PAT) rose by 4% between the financial years ending in 2024 and 2025. Over the three-year period, all reported financial indicators demonstrated an upward trend. Assets grew from 712.47 Crore in 2023 to 1,354.68 Crore in 2025. Total Income increased from 529.18 Crore to 922.36 Crore, while Profit After Tax rose from 42.84 Crore to 77.82 Crore. Other metrics, including EBITDA, Net Worth, Reserves and Surplus, and Total Borrowing, also saw consistent increases.

KPI

| KPI | Values |

|---|---|

| ROE | 16.63% |

| ROCE | 23.34% |

| Debt/Equity | 0.58 |

| RoNW | 16.63% |

| PAT Margin | 8.44% |

| EBITDA Margin | 17.50% |

| Price to Book Value | 3.81 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.