Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Yashhtej Industries (India) Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Yashhtej Industries (India) Ltd

Listing At: BSE (SME)

Overview

Yashhtej Industries (India) Limited is a growing agribusiness company based in Latur, Maharashtra. Since our inception, we’ve been engaged in the production of Soybean Crude Oil and Soybean De-Oiled Cake (DOC), which is widely used as animal feed in the poultry industry.

At Yashhtej, we are committed to sustainable growth and efficient operations. Our factory is equipped with smart technology that helps prevent damage to the equipment, reduces waste, and minimizes downtime by allowing operators to address issues in real time We’ve also invested in renewable energy through the installation of a solar power plant for captive consumption.

With a focus on quality, innovation, and value addition, we aim to become a trusted name in the edible oil industry.

The Company is pursuing vertical integration by establishing a Refinery Plant to convert soybean crude oil into edible oil, thereby expanding into value-added products and catering to both B2B and B2C markets. Also, our Company is developing a 5 MW solar power project, with the generated electricity to be supplied to the State electricity board.

Shariah Status

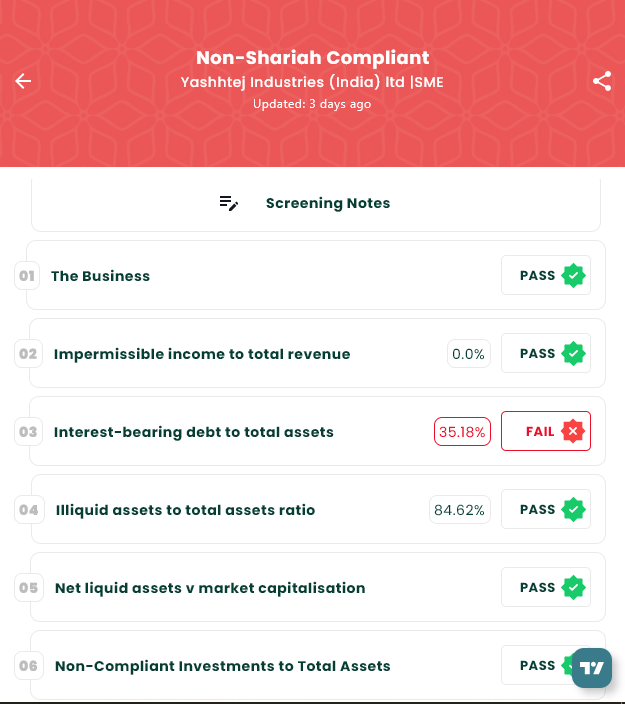

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Feb 18, 2026 |

| IPO Close Date | Feb 20, 2026 |

| Tentative Allotment | Feb 23, 2026 |

| Initiation of Refunds | Feb 24, 2026 |

| Credit of Shares to Demat | Feb 24, 2026 |

| Tentative Listing Date | Feb 25, 2026 |

Financials

Based on the restated financials provided, Yashhtej Industries (India) Limited has demonstrated aggressive exponential growth between FY23 and FY25, transitioning from a loss-making entity to a high-growth profitable enterprise.

Highlights

- Revenue Growth: The company’s total income surged from ₹12.00 crore in FY23 to ₹324.96 crore in FY25, a massive 27x increase. As of the half-year ended September 30, 2025, revenue remains strong at ₹191.22 crore.

- Profitability: Yashhtej successfully turned around from a net loss of -₹0.58 crore in FY23 to a Profit After Tax (PAT) of ₹11.57 crore in FY25. Current H1 FY26 PAT stands at ₹7.25 crore, indicating sustained momentum.

- Operational Efficiency: EBITDA followed a similar trajectory, rising to ₹21.02 crore in FY25 with a healthy margin improvement.

Capital Structure

The company’s Net Worth grew significantly to ₹26.87 crore by September 2025, supported by a rise in reserves. However, growth is heavily leveraged, with Total Borrowings at ₹37.47 crore. While debt has decreased from its March 2025 peak of ₹43.85 crore, the company remains capital-intensive as it expands its soybean processing and solar power ventures.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.