Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Star Imaging and Path Lab Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Star Imaging and Path Lab Ltd

Industry: Healthcare Service Provider

Listing At: BSE SME

Overview:

Star Imaging & Path Lab is committed to using world-class technology to deliver in-depth and up-to-date diagnostic studies that support better healthcare decisions. Their mission focuses on building a healthier community by promoting health awareness and shifting the focus from reactive treatment to preventive care and early detection across all age groups and genders.

Over the years, Star Imaging has consistently provided top-quality diagnostic services in Delhi/NCR. Their vision is to continuously raise their own standards through ongoing improvements in service excellence, patient care, and the adoption of the latest technologies — all while ensuring affordability for everyone.

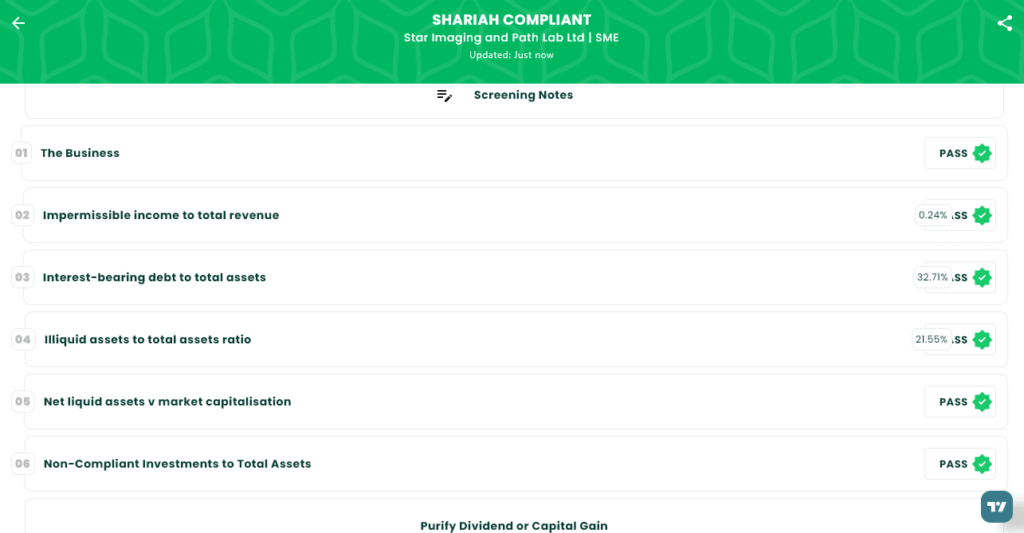

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 8, 2025 |

| IPO Close Date | Tue, Aug 12, 2025 |

| Tentative Allotment | Wed, Aug 13, 2025 |

| Initiation of Refunds | Thu, Aug 14, 2025 |

| Credit of Shares to Demat | Thu, Aug 14, 2025 |

| Tentative Listing Date | Mon, Aug 18, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 12, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,84,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,84,000 |

| S-HNI (Min) | 3 | 3,000 | ₹4,26,000 |

| S-HNI (Max) | 7 | 7,000 | ₹9,94,000 |

| B-HNI (Min) | 8 | 8,000 | ₹11,36,000 |

Financials

Star Imaging & Path Lab Ltd. has demonstrated decisive financial growth, with key metrics reflecting a strong performance trajectory. The company’s revenue increased by 5% and its profit after tax (PAT) surged by a significant 28% between the financial years ending March 31, 2024, and March 31, 2025. This growth is underpinned by solid improvements across the board. Total Assets grew from 81.64 crore to 98.16 crore, while Total Income rose from 79.97 crore to 83.79 crore. Profit After Tax (PAT) escalated from 12.45 crore to 15.96 crore, showcasing enhanced profitability. Furthermore, EBITDA experienced a robust increase, climbing from 22.34 crore to 28.60 crore. The company’s Net Worth strengthened from 31.35 crore to 47.15 crore, and Reserves and Surplus expanded to 33.65 crore from 29.85 crore, indicating a solid financial foundation. While Total Borrowing increased slightly from 30.64 crore to 32.73 crore, the overall financial health and growth momentum are undeniable. These figures unequivocally confirm the company’s strong operational performance and strategic effectiveness.

KPI

| KPI | Values |

|---|---|

| ROE | 40.65% |

| ROCE | 29.92% |

| Debt/Equity | 0.69 |

| RoNW | 40.65% |

| PAT Margin | 19.10% |

| EBITDA Margin | 34.22% |

| Price to Book Value | 4.07 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.