Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Euro Pratik Sales Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Euro Pratik Sales Ltd

Industry: Consumer Durables

Listing At: NSE & BSE (Mainboard)

Overview:

Euro Pratik Sales Limited, established in 2010, is a leading Indian company in the decorative wall panel and laminates industry. Operating as a seller and marketer under the brands “Euro Pratik” and “Gloirio,” the company has pioneered the introduction of innovative products like Louvers, Chisel, and Auris to the Indian market. They are recognized as one of India’s largest and most organized brands in the decorative wall panel sector.

A Pioneer in Design and Innovation

Euro Pratik’s core identity is built on staying ahead of industry trends. The company designs its decorative wall panels and laminates to align with modern architectural and interior design trends. This focus on innovation is evident in its business model, which acts like a “fast-fashion” brand. As of March 31, 2025, they offered over 30 product categories and 3,000 designs and had launched 113 product catalogs in just four years. This rapid pace allows them to constantly introduce new designs by analyzing consumer feedback and emerging styles, materials, and technologies. This forward-thinking approach is a key competitive advantage, ensuring their product portfolio remains fresh and relevant.

Diverse and High-Quality Product Offerings

The company’s product range is categorized into two main areas: Decorative Wall Panels and Decorative Laminates.

- Decorative Wall Panels: These products are designed for both aesthetics and functionality. They offer more than just a decorative finish, providing insulation, soundproofing, and easy installation. They are a durable and cost-effective solution for both residential and commercial spaces, providing a superior alternative to traditional wall coverings like wallpaper, veneer, and paint.

- Decorative Laminates: Made from high-quality materials like PVC, these laminates provide a stylish and durable finish for various applications, including furniture, cabinetry, countertops, and wall coverings. They offer excellent protection against daily wear and tear, ensuring longevity and a premium look.

Commitment to Sustainability and Health

A significant aspect of Euro Pratik’s value proposition is its commitment to creating products that are eco-friendly and safe for consumers. Their products are positioned as a high-quality, sustainable alternative to traditional wall decoration methods like wood and paint, which can be less environmentally conscious. The company’s offerings are made from recycled and eco-friendly materials and are free from harmful heavy metals like lead and mercury. They also feature anti-bacterial and anti-fungal properties, making them a healthier choice for interiors. This focus on environmental consciousness and consumer well-being sets them apart in the Indian market.

Strategic Business and Market Presence

Since its incorporation, Euro Pratik has strategically grown its market presence. The company operates on an asset-light business model, relying on long-term global partnerships rather than owning extensive manufacturing facilities. This allows for flexibility and scalability. They have built a vast distribution network across India, spanning 116 cities and managing 180 distributors across 25 states and five union territories as of March 31, 2025. This extensive network enables them to reach a wide range of customers, from major metropolitan areas to smaller Tier-III cities.

Looking beyond the domestic market, Euro Pratik has already established an international footprint, exporting to six countries, including Singapore, the UAE, and Australia. The company has a clear vision for global expansion, with plans to explore international markets and selectively assess growth opportunities through organic or inorganic means. They aim to capitalize on their strong market position and diverse product offerings to expand their customer base both in India and abroad.

In summary, Euro Pratik’s success is built on a foundation of innovation, a diverse and high-quality product portfolio, a strong commitment to sustainability, and a robust, asset-light business model that allows for extensive reach and future growth. They are a leader in their field, continuously striving to stay at the forefront of the industry by offering superior, trend-setting, and eco-friendly products.

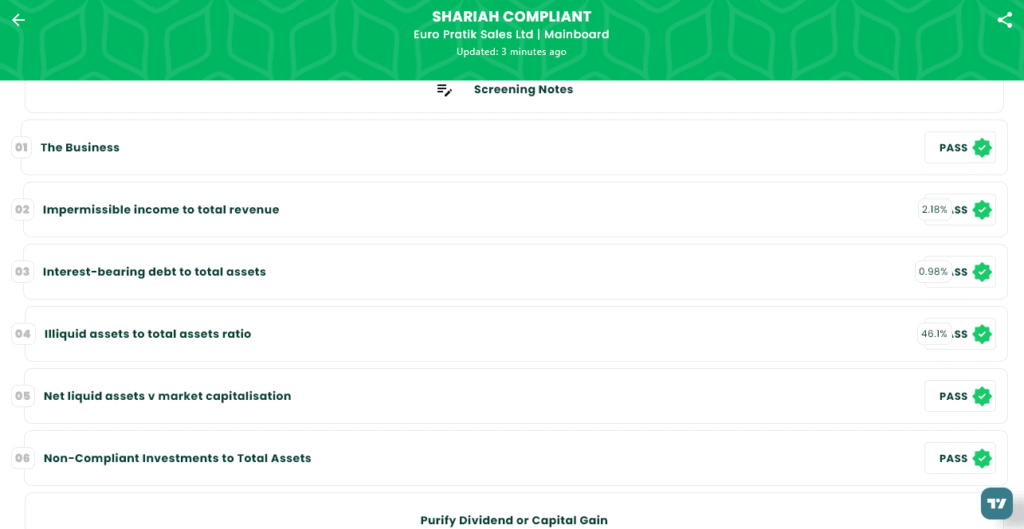

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 16, 2025

- IPO Close Date: Wednesday, September 18, 2025

- Tentative Allotment: Thursday, September 19, 2025

- Initiation of Refunds: Monday, September 22, 2025

- Credit of Shares to Demat: Monday, September 22, 2025

- Tentative Listing Date: Tuesday, September 23, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 18, 2025

Lot Size

| Investor Category | Application | Lots | Shares | Amount (₹) |

| Retail | Minimum | 1 | 60 | ₹14,820 |

| Maximum | 13 | 780 | ₹1,92,660 | |

| S-HNI | Minimum | 14 | 840 | ₹2,07,480 |

| Maximum | 67 | 4,020 | ₹9,92,940 | |

| B-HNI | Minimum | 68 | 4,080 | ₹10,07,760 |

Financials

Based on the financial data, Euro Pratik Sales Ltd. has shown strong growth between the fiscal years ending March 31, 2024, and March 31, 2025. The company’s revenue (Total Income) grew by a significant 27%, rising from ₹230.11 crore to ₹291.52 crore. This increase in income indicates robust sales and business expansion.

The company’s profit after tax (PAT) also saw a healthy increase of 22%, from ₹62.91 crore to ₹76.44 crore. This suggests that the company is not only earning more but is also managing its costs effectively to maintain profitability.

Furthermore, the company’s assets and net worth have both seen substantial increases, with assets growing from ₹174.49 crore to ₹273.84 crore and net worth rising from ₹155.73 crore to ₹234.49 crore. This indicates that the company’s financial foundation has become much stronger.

Interestingly, total borrowing has decreased from ₹3.00 crore in 2023 to ₹2.68 crore in 2025, which means the company is relying less on debt. Overall, the financial performance shows that Euro Pratik Sales Ltd. is growing both in sales and profitability while also improving its balance sheet health.

KPI

| KPI | Values |

|---|---|

| ROE | 39.18% |

| ROCE | 44.58% |

| Debt/Equity | 0.01 |

| RoNW | 32.60% |

| PAT Margin | 26.08% |

| EBITDA Margin | 38.74% |

| Price to Book Value | 10.77 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.