Forex is the biggest financial market worldwide, with about $7.5 trillion traded daily. It runs all day and night, five days a week, making it appealing for people looking to invest. Many individuals trade in Forex to earn money by taking advantage of changes in currency values. But the critical question is

Is Forex trading allowed in Islam?

In short, no! Forex trading is not permissible, but there are some conditions under which it is and when it could become permissible. So, let’s explore them one by one.

What is Forex Trading?

Forex trading involves exchanging one country’s currency for another and earning a profit when the exchange rate changes. For example, if someone converts Indian rupees (INR) into US dollars (USD) and later converts them back when the value changes, they can profit.

Islamic scholars consider different currencies to be separate types of goods. Therefore, exchanging them is allowed if done correctly. However, the way Forex trading happens today creates several issues from an Islamic perspective.

Islamic Finance Principles and Forex Trading

Islamic finance follows strict ethical rules, and two important things are strictly forbidden:

1. Riba (Interest): Any form of interest is prohibited in Islam because it leads to unfair advantage and exploitation.

2. Gharar (Uncertainty): Business transactions must be clear, transparent, and free from excessive uncertainty or speculation.

Since most Forex trading methods involve these prohibited elements, it raises serious concerns for Muslim traders.

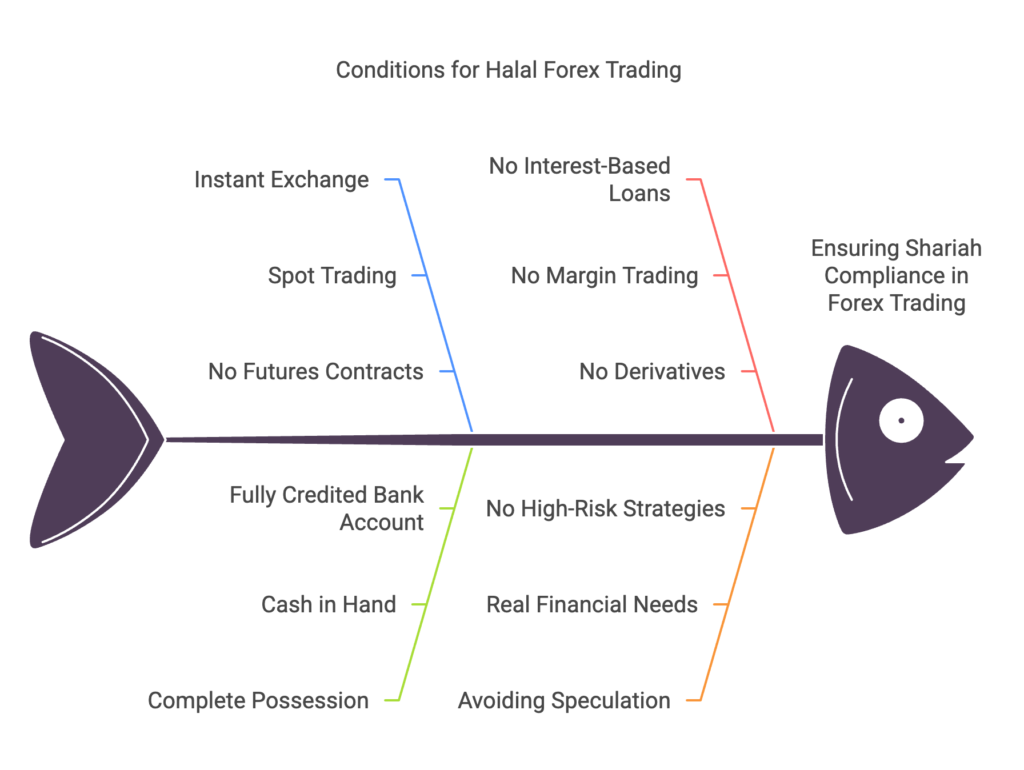

Conditions for Halal Forex Trading

For Forex trading to be considered halal, it must follow these critical conditions:

1. Instant Exchange of Currencies

Currency exchange must happen immediately, hand-to-hand. This is called spot trading, where both parties exchange currencies on the spot. Any trade with a delay in settlement, such as futures contracts, is not allowed because it involves uncertainty and speculation.

2. Complete Possession Before Selling

A trader must have full control over a currency before selling it again. This means either

- Having cash in hand, or

- Having the amount fully credited to a bank account with full access.

- Without ownership, selling a currency is not Shariah-compliant.

3. No Interest-Based Loans

In Islam, using interest-based loans for Forex trading, such as margin trading or leveraged trading from conventional brokers, is prohibited.

Similarly, derivative instruments like futures and options are prohibited because they involve too much uncertainty and speculation.

4. Avoiding Speculation and Gambling-Like Trading

A trader should invest based on real financial needs, not just gamble on price movements.

High-risk strategies that resemble gambling are considered haram in Islam.

5. Fair Exchange Rates and Transparency

The exchange rate must be based on actual market conditions, and currency prices should not be unfairly manipulated.

Islamic finance promotes honesty and fairness in all financial transactions.

Is Halal Forex Trading Possible?

Some brokers offer Islamic (swap-free) accounts, which remove interest charges. However, traders must carefully check whether these accounts have hidden fees that act as indirect interest.

To ensure Shariah compliance, a trader should:

- Trade only in spot transactions (instant exchange).

- Ensure full ownership of the currency before selling.

- Avoid high-risk speculation and gambling-like behavior.

- Verify if their broker’s Islamic account is genuinely free from interest.

Conclusion

Currently, no Forex trading platform fully follows Islamic principles, as they all involve interest, uncertainty, and speculation. Therefore, Forex trading in its current form cannot be considered Shariah-compliant.

That said, Forex trading is not inherently haram; its permissibility depends on strict adherence to Shariah principles. If a trading method avoids interest, uncertainty, and speculation, it can be considered halal.

Muslim traders are advised to exercise caution, follow ethical trading practices, and seek guidance from Islamic scholars when uncertain.

May Allah guide us toward halal earnings and protect us from haram sources. Ameen.

For further details, please refer to our sources below: Askimam.org: https://askimam.org/public/question_detail/46766

AAOIFI: https://aaoifi.com/ss-1-trading-in-currencies/?lang=en

Islamqa.info: https://islamqa.info/en/answers/125758/is-islamic-forex-allowed